Aurelius Capital Launches $150M Defense-Tech Fund Led by Israeli and U.S. Security Veterans

Aurelius Capital, led by Israeli and U.S. defense veterans including former NSA and Mossad officials, has launched a $150 million defense-tech fund focused on dual-use, non-lethal technologies.

Tel Aviv / New York / London – November 2025 - A new force is entering the defense innovation arena. Aurelius Capital, a fund led by top Israeli and U.S. security veterans, has officially launched with an initial close of $50 million, targeting a total fund size of $150 million. Positioned between venture capital speed and private equity discipline, the fund aims to back breakthrough technologies shaping the next decade of defense and security.

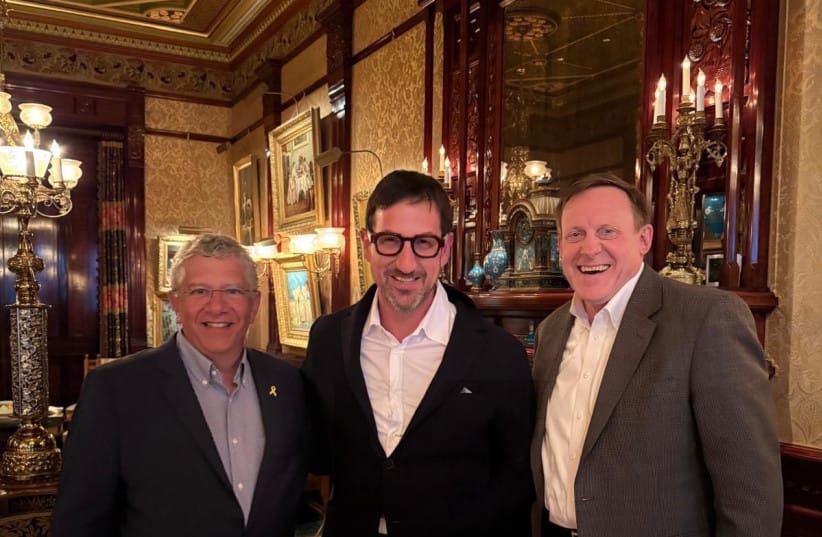

The leadership team reads like a who’s who of modern security and intelligence. Alon Lifshitz and Tomer Jacob — both partners at Hanaco Ventures — are joined by Admiral (Ret.) Michael Rogers, former director of the U.S. National Security Agency (NSA); Maj.-Gen. (Res.) Amir Eshel, former commander of the Israeli Air Force; and Udi Lavi, former deputy director of the Mossad.

The team’s combined expertise spans intelligence, cyber operations, and strategic defense planning — offering what Aurelius describes as a “unique fusion of operational depth and financial reach.” Lifshitz and Jacob will maintain their positions at Hanaco Ventures, ensuring alignment between Hanaco’s $2.5 billion portfolio and Aurelius’s more defense-focused mandate.

Responding to a Global Security Shift

The launch comes amid the largest wave of defense and dual-use investment since the Cold War. With conflicts reshaping Europe, the Middle East, and Asia — and threats increasingly targeting infrastructure, space, and cyberspace — the demand for next-generation technologies is soaring.

“The launch of Aurelius comes at a critical time,” said Lifshitz. “The demand for innovative solutions for both defense and civilian markets is at its peak. We combine access to global capital with unmatched operational experience — that’s our edge.”

Strategy: “Shields, Not Swords”

Unlike traditional defense funds, Aurelius Capital emphasizes non-lethal, defensive, and dual-use technologies — what Lifshitz calls “shields, not swords.” The fund is targeting early- and growth-stage companies specializing in cybersecurity, drone detection, AI-based threat analysis, autonomous systems, and advanced materials that serve both national and commercial needs.

This approach reflects a strategic evolution: rather than pure weapons manufacturing, Aurelius is betting on technologies that enhance resilience, situational awareness, and defense interoperability.

Redefining Defense-Tech Investing

For Lifshitz, who has spent two decades at the intersection of Israeli venture capital and technology, Aurelius represents a turning point. “What we’re seeing now is the next era of defense — where national security meets deep-tech,” he said. “Geopolitics created the perfect storm. Great powers struggle to win asymmetric wars. The future belongs to those who can fuse innovation with defense purpose.”

The fund’s founders argue that Israel’s October 7th experience fundamentally changed the way investors and engineers view defense innovation. “Since that day, our ability to give back is through building the new generation of defense and dual-use companies,” Lifshitz said. “Whatever secures Israel’s future will secure the West’s future as well.”