Europe’s 7 Fastest-Rising Drone Startups Reshaping the Future of UAV Warfare

Europe’s drone ecosystem is rapidly evolving as a new generation of startups drives innovation in ISR, autonomy, and next-generation UAV systems. These seven companies stand out for their technology, momentum, and growing impact on Europe’s defense and security landscape.

Europe’s drone sector is undergoing rapid transformation as a new wave of startups pushes technological boundaries, accelerates autonomy, and reshapes both defense and civilian UAV applications. While global attention often gravitates toward U.S., Israeli, or Chinese drone innovators, Europe is quietly building a competitive ecosystem of high-performance platforms, AI-driven mission systems, and dual-use unmanned capabilities.

Below is an overview of seven of the most dynamic and influential drone startups currently shaping Europe’s UAV future.

1. Quantum Systems (Germany)

One of Europe’s fastest-rising drone manufacturers, Quantum Systems has become a key player in fixed-wing VTOL reconnaissance drones. The company’s flagship platforms — Vector and Trinity — are now widely deployed for defense, surveillance, and civilian mapping.

Quantum recently expanded operations in the UK and continues integrating advanced AI, modular sensor payloads, and NATO-compatible mission systems. For many analysts, Quantum represents the closest European answer to the U.S.-style defense drone scale-up.

2. TEKEVER (Portugal / UK)

Portugal’s TEKEVER has rapidly evolved into a UAV powerhouse, delivering maritime surveillance drones, ISR platforms, and data-fusion systems to European governments. The company recently achieved "unicorn" valuation status and expanded production capacity in the UK.

TEKEVER’s success stems from years of operational deployment, including border monitoring, anti-trafficking missions, and maritime patrol operations. Its ability to combine UAV platforms with analytics and AI gives it a significant strategic advantage.

3. Wingcopter (Germany)

Wingcopter specializes in tilt-rotor eVTOL drones capable of long-range delivery operations and rapid deployment missions. Though largely civilian-focused, the company’s technology is dual-use by nature, and its reliability makes it suitable for humanitarian response and critical logistics.

The startup has secured international partnerships and continues pushing automation in drone delivery networks.

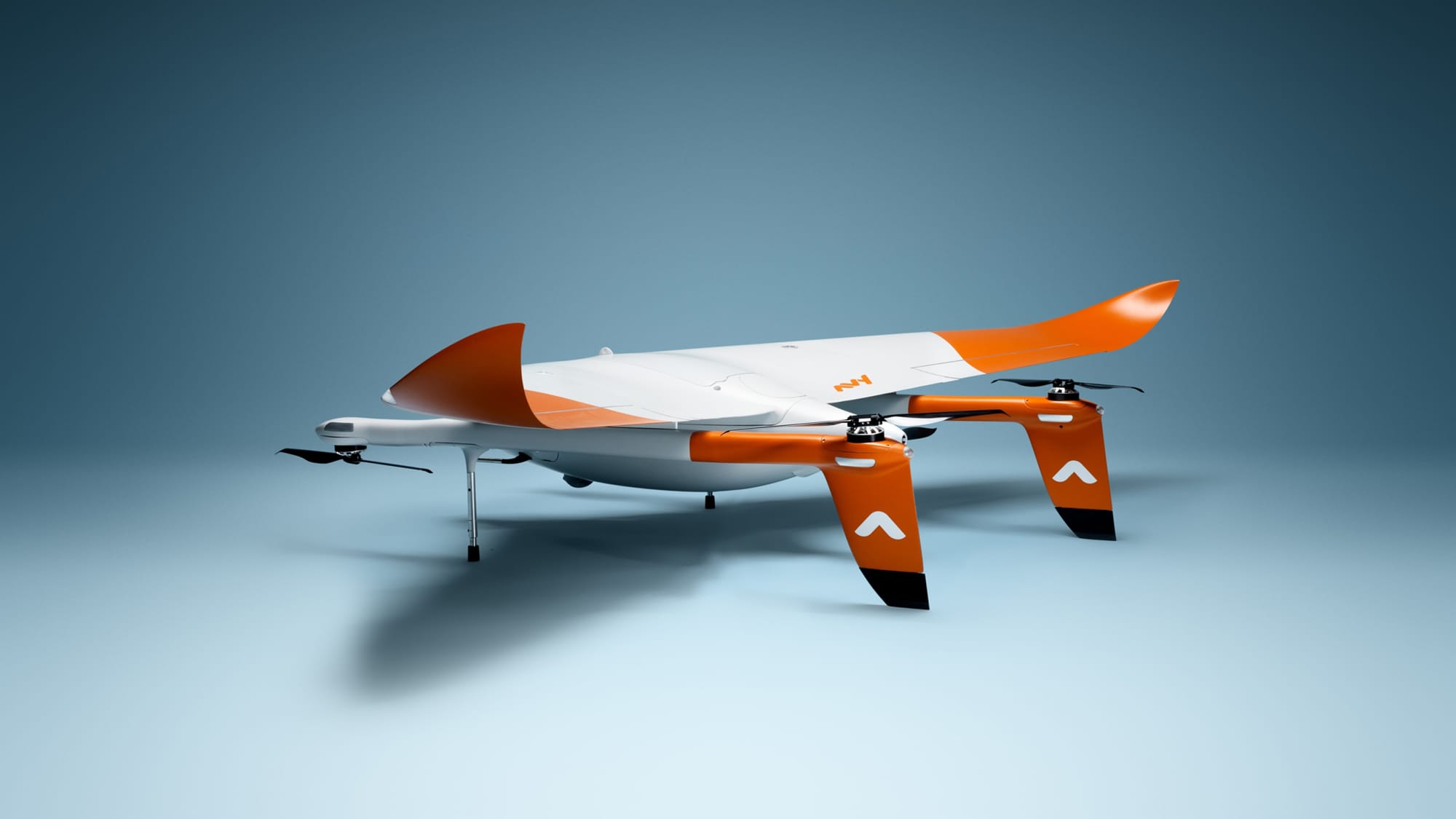

4. Avy (Netherlands)

Avy develops VTOL fixed-wing drones designed for medical delivery, critical infrastructure monitoring, and long-distance autonomous missions. Its platforms emphasize safety, endurance, and rugged performance, making them valuable for governments and emergency services.

With growing demand for civil-security UAVs across Europe, Avy is positioned at the intersection of commercial and public-sector deployment.

5. Granta Autonomy (Lithuania)

A standout Baltic defense-tech startup, Granta Autonomy focuses on tactical mini-drones optimized for contested environments, including GPS-denied operations. The Hornet XR platform has drawn attention for its compact design, hardened communication systems, and mission flexibility.

With Europe’s shift toward agile, attritable aerial assets, Granta represents a new generation of locally-developed tactical UAV capabilities.

6. Helsing (Germany / EU)

Although best known for AI-enabled defense software, Helsing is increasingly active in autonomous systems and unmanned platforms. The company collaborates with European defense primes and develops technology for battlefield perception, target detection, and drone-swarm applications.

Helsing’s integration of AI into UAV mission cycles positions it as one of Europe’s most strategically important defense-tech startups.

7. STARK (Germany / UK)

STARK operates in the high-risk, high-impact segment of strike drones and loitering munitions. The startup is gaining visibility for its advanced autonomous flight systems and modular UAV architectures designed for deep-precision missions.

Although regulatory pressure makes this segment more complex, STARK reflects Europe’s accelerating shift toward next-generation autonomous combat systems.

Europe’s Drone Ecosystem Is Entering a New Phase

The rise of these seven startups signals a broader trend: European governments and investors are finally moving toward accelerated UAV development, local production, and autonomy-driven capabilities. With ongoing conflicts shaping procurement priorities, Europe’s drone sector is transitioning from fragmented initiatives to a more coordinated industrial momentum.

Whether for ISR, logistics, surveillance, or combat roles, the continent’s new UAV innovators are beginning to redefine what European drone power looks like in the coming decade.